Disinflation at the Thanksgiving Table

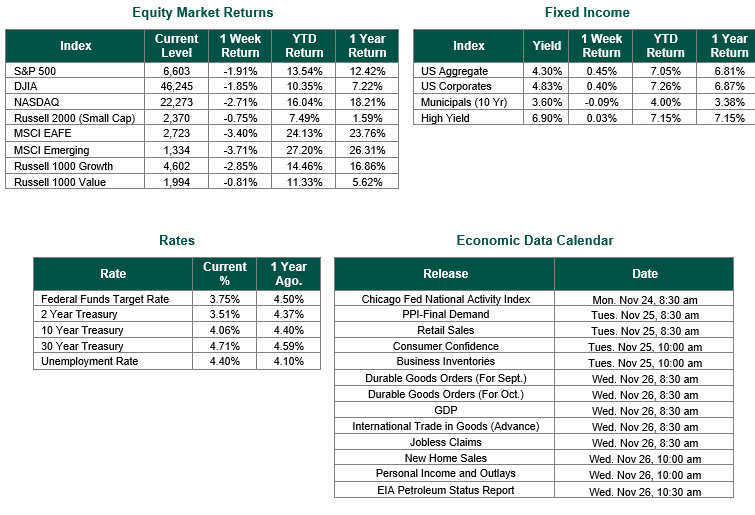

Global equity markets finished mostly negative for the week. In the U.S., the S&P 500 Index closed the week at a level of 6603, representing a decrease of 1.91%, while the Russell Midcap Index moved +0.39% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.75% over the week. As developed international equity performance and emerging markets were negative, returning -3.40% and -3.71%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.06%.

Each year, the American Farm Bureau Federation’s Thanksgiving Dinner Index provides one of the most relatable and timely snapshots of food-price inflation at the consumer level. For 2025, the cost of a traditional Thanksgiving meal for 10 people, according to this index, has fallen for the third consecutive year to $55.18 — a 5% decline from 2024 and 14% below the 2022 peak of $64.05.

This continued moderation in food prices is particularly meaningful in the context of the inflationary cycle that has persisted since 2021. Consider that:

- The 2021–2022 period saw the sharpest spike in food and commodity prices in four decades, driven by supply-chain disruptions, energy shocks, and avian influenza outbreaks, which pushed the same Thanksgiving basket to a record $64.05.

- The period from 2023 to 2025 has marked a clear disinflationary trend, with the 2025 cost now essentially flat with 2020 levels on an inflation-adjusted basis.

Food CPI is a leading indicator within the broader Consumer Price Index. The sustained cooling we are now observing in certain retail food prices — particularly in proteins and grain-based staples — reinforces the Federal Reserve’s progress toward its 2% inflation target and supports the market’s growing conviction that the rate-cutting cycle should continue, with the probability of another cut coming in December now sitting at 76%, according to CME Group.

Regional and category divergence remains, however, as fresh produce and sweet potatoes saw sharp increases due to weather-related supply shocks, reminding us that certain commodity segments can still experience volatility even as the broader inflation impulse fades.

In summary, a $55 Thanksgiving dinner in 2025 — down materially from the 2022 peak yet still above pre-pandemic levels — serves as a tangible reminder that the worst of the post-pandemic inflation shock has passed, while certain pockets of price pressure persist. This backdrop continues to support our moderately constructive outlook on risk assets, as well as our emphasis on diversification and quality in client portfolios.

We would be remiss not to mention Nvidia’s earnings release last week, as they once again “knocked the cover off the ball” by beating both earnings and revenue estimates. These results, in addition to Nvidia’s forward-looking guidance, once again reminded us that the AI revolution is alive and well. Patience and diversification will be key for companies and investors who allocate capital to this transformative area of technology.

Wishing you and your families a happy and healthy Thanksgiving!

Equity and Fixed Income Index returns sourced from Bloomberg on 11/21/25. “Thanksgiving Food Prices” sourced from the American Farm Bureau Federation on 11/19/25.. Calendar Data from Econoday as of 11/24/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.