Fireworks on Wall Street

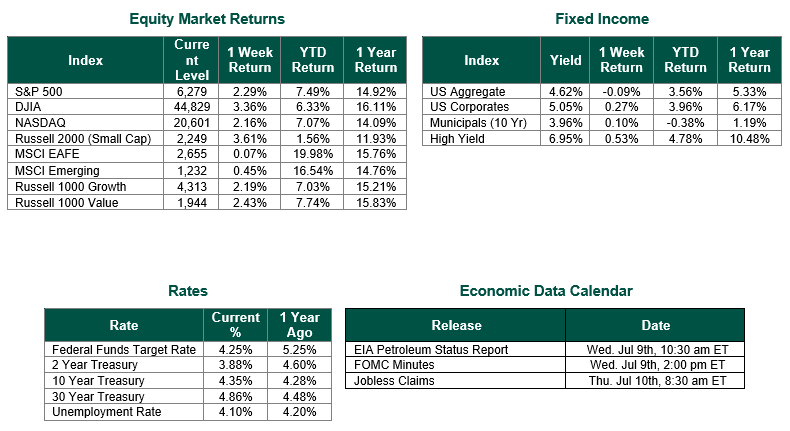

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,279, representing a gain of 2.29%, while the Russell Midcap Index moved 2.50% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.61% over the week. As developed international equity performance and emerging markets were positive, returning 0.07% and 0.45%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.35%.

We hope everyone enjoyed a nice Independence Day weekend. Last week, U.S. markets navigated a holiday-shortened trading period with optimism, driven by a mix of economic data and trade policy developments. Despite the Independence Day holiday break, the economy and markets responded to key events that shaped investor sentiment and set the stage for the weeks ahead.

A stronger-than-expected June jobs report, released on Thursday, following a weaker-than-expected jobs report earlier in the week, was a major catalyst for market momentum. The U.S. economy added 147,000 nonfarm payrolls, surpassing forecasts of 110,000. This solid employment growth underscored the resilience of the U.S. economy, even as trade policy changes loomed. However, the report appeared to dampen expectations for an immediate Federal Reserve interest rate cut, with the probability of a July cut dropping significantly to just 4.7%, from 20.7% the week prior, according to CME Group. On the flip side, the probability of a September rate cut (remembering that there is no FOMC meeting scheduled for August) is now nearly 65%.

Trade policy continued to remain a focal point, with the U.S. announcing a new trade deal with Vietnam that included a 20% tariff on overall imports and a 40% tariff on transshipments. This agreement sparked optimism in certain sectors, particularly apparel and footwear, as it signaled progress in navigating global trade complexities. Meanwhile, the approaching July 9 tariff pause deadline continues to keep investors on edge, with ongoing negotiations adding both opportunity and uncertainty to market dynamics.

Treasury yields rose as the market anticipated the signing of the Trump administration’s “One Big Beautiful Bill,” which took place on July 4, with the 10-year U.S. Treasury note ticking up to 4.30% and the 2-year U.S. Treasury bill at 3.78%, reflecting increased concerns about federal debt levels as a result of the passage of the bill.

Overall, last week’s performance highlighted a market buoyed by economic resilience and trade policy optimism, tempered by caution over tariff deadlines and overbought conditions. As investors await clarity on trade negotiations and monitor upcoming economic data, the interplay of growth, policy, and global dynamics will likely continue to shape market trends.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 7/3/25. Weekly Jobless Claims sourced from the U.S. Department of Labor. Economic Calendar Data from Econoday as of 7/7/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.