Market Anxiety Continues over Tariff Uncertainties

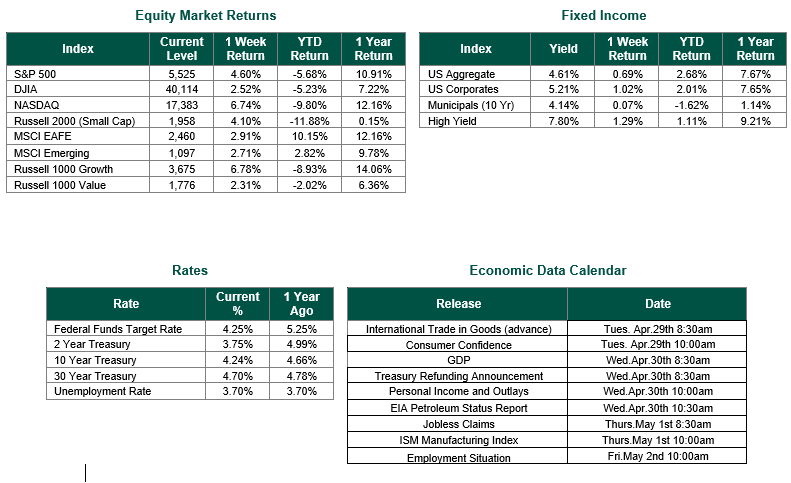

Global equity markets finished positive for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,525, representing a gain of 4.60%, while the Russell Midcap Index moved -3.4% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 4.10% over the week. As developed international equity performance and emerging markets were strong, returning 2.91% and 2.71%, respectively. Finally, the 10-year U.S. Treasury yield moved up, closing the week at 4.14%.

Last week saw notable movements in U.S. economic indicators, with key metrics such as consumer confidence declining and shifts in inflation revealing persistent concerns about tariffs and economic growth. Throughout this Update, we will provide our readers with analysis concerning this data which includes PMI Composite Flash report for April, New Home Sales for March, Durable Goods Orders for March, Weekly Jobless Claims and the University of Michigan’s Consumer Sentiment for April.

On Wednesday, the S&P Global US Composite PMI “flash” data showed a decline in private sector activity, falling to 51.2 in April from 53.5 in March. This indicates the slowest private sector activity growth in 16 months. While the manufacturing PMI edged up to 50.7, a two-month high, the services PMI declined to 51.4, a two-month low. Business expectations for the year ahead also dropped to one of the lowest levels since the pandemic.

Sales of new U.S. single-family homes increased more than expected in March as buyers rushed to take advantage of a decline in mortgage rates, but a gloomy economic outlook poses a challenge to the housing market recovery. New home sales jumped 7.4% to a seasonally adjusted annual rate of 724,000 units last month, the highest level since September 2024, the Commerce Department’s Census Bureau said on Wednesday. The sales pace for February was revised down to a rate of 674,000 units from the previously reported 676,000 units.

A report released by the Commerce Department on Thursday showed new orders for U.S. Manufactured durable goods surged much more than expected in the month of March amid a spike in orders for transportation equipment. Durable goods orders shot up by 9.2% in March after a sluggish 0.9% increase in February. The actual results far exceeded the consensus estimate of 2.0%.

The labor market remains resilient, with initial jobless claims reported at 226,000, slightly above the consensus forecast.

On Friday, the University of Michigan released its final consumer sentiment index for April, which dropped to 52.2, a decrease of 8.4% from the previous month’s reading of 57. This marks the fourth consecutive month of declines and the lowest level since July 2022. Consumer expectations, particularly for the future, have also seen a significant decline.

The economic data from last week illustrates a cautious landscape shaped by consumer anxiety over inflationary pressure and unstable trade relationships. As the market awaits further guidance on employment and economic policies, the community is attentive to how these trends will impact future decisions both in the financial markets and the broader economy.

Best wishes for the Week ahead.

Equity and Fixed Income Index returns sourced from Bloomberg on 4/25/25.Composite PMI data is sourced from S&P Global. New Home Sales and Durable Goods data are sourced from the Commerce Department. Consumer Sentiment data is sourced from the University of Michigan. Economic Calendar Data from Econoday as of 4/25/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.