The Tariffs and Markets Roller Coaster Ride Continues

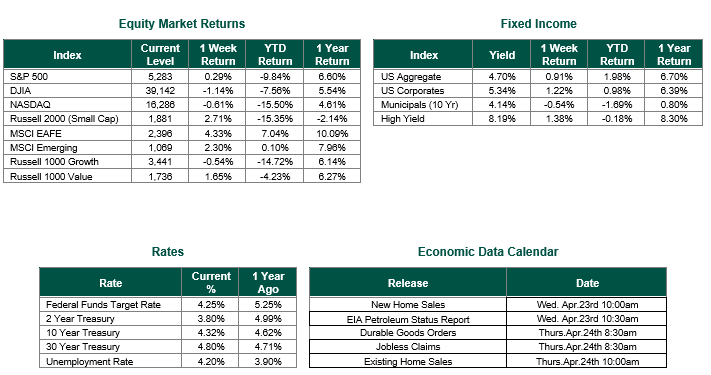

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,283, representing a gain of 0.29%, while the Russell Midcap Index moved 1.65% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.71% over the week. Developed international equity performance and emerging markets were mixed, returning 4.33% and 2.30%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly lower, closing the week at 4.32%.

Last week, global markets grappled with heightened volatility as trade policy uncertainties dominated news headlines. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq all fell in a holiday-shortened week, retreating from the prior week’s 5.7% S&P 500 surge. President Trump’s April 2 tariff announcement, partially paused for 90 days for many countries, provided fleeting relief, but ongoing exclusions for major trading partners like China fueled trade war fears, keeping investors cautious.

Sector performance has diverged sharply thus far in 2025. The information technology has faced numerous headwinds from export restrictions, while financials have benefited from robust Q1 earnings. Defensive sectors, including utilities and consumer staples, gained traction as investors sought stability amid uncertainty. Bond markets showed signs of calming, with 10-year U.S. Treasury yields easing to 4.315% from 4.493%, reflecting a retreat from prior sell-off pressures. The VIX fear gauge (a measure of market volatility) dipped below 30, hinting at reduced market panic, though sentiment remains fragile.

On the macroeconomic front, the U.S. economy is sending mixed signals. A strong Q1 earnings season underscored corporate resilience, but tariff-related guidance cuts clouded outlooks. The labor market has held firm, with unemployment steady at 3.8%, though the focus has now shifted to potential supply chain disruptions from trade policies. Globally, China’s retaliatory stance and Europe’s cautious response amplified concerns about a broader economic slowdown, with Brent Crude Oil slipping 4% on demand fears.

The Federal Reserve also maintained its hawkish tone last week, with Chair Powell emphasizing vigilance on potential tariff-driven inflation risks. Markets are now pricing in no rate cuts before mid-2025 (though this could certainly change over the course of the next month), shifting attention to upcoming retail sales and industrial production data for clues on consumer and manufacturing health. Currency markets saw the dollar weaken slightly, down 0.8% against a basket of currencies, as safe-haven flows favored the Japanese Yen and Swiss Franc.

As trade tensions simmer, investors should brace for a bumpy road ahead, while maintaining perspective and staying true to their risk tolerance and longer-term financial plans. The interplay of policy, earnings, and global dynamics will likely shape the direction of the markets in the weeks ahead.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 4/17/25. Unemployment rates are sourced from The Bureau of Labor Statistics. Economic Calendar Data from Econoday as of 4/21/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Some of the securities discussed in this update are held in current series of SmartTrust® unit investment trusts (UITs), where Hennion & Walsh serves as sponsor. This update is for information purposes only and should not be used or construed as an offer to sell, a solicitation of any offer to buy, or a recommendation of the merits of an investment in any security.